Focusing on the forest, not the trees

Over the last decade, the escalation of globalisation, leverage and information flow through the internet has made markets increasingly correlated, especially during market downturns. What was once considered a diversified portfolio (a mix of U.S. and European equities) is no longer considered as such or remotely immune to downturns. This correlation has also made generating excess returns from specific security selection ('alpha') increasingly difficult.

Several studies have clearly shown that the single largest determinant in investment returns comes from the asset allocation decision. This decision far outweighs the timing or selection of individual securities. At Knotstone, we aim to ascertain big-picture asset class moves and themes and try to position portfolios to take advantage of or act defensively against them.

Understanding your investment objectives

Many institutions rightly use model portfolios as a way of providing consistency and discipline across thousands of client accounts. Nevertheless, we believe an industrialised investment process discourages distinctive mandates and client restrictions. We see model portfolios as a template for managing money rather than a straightjacket from which deviation and special requests are discouraged. We encourage our clients to express their preferences or aversions to prove that we are genuinely different and can cater to special requests.

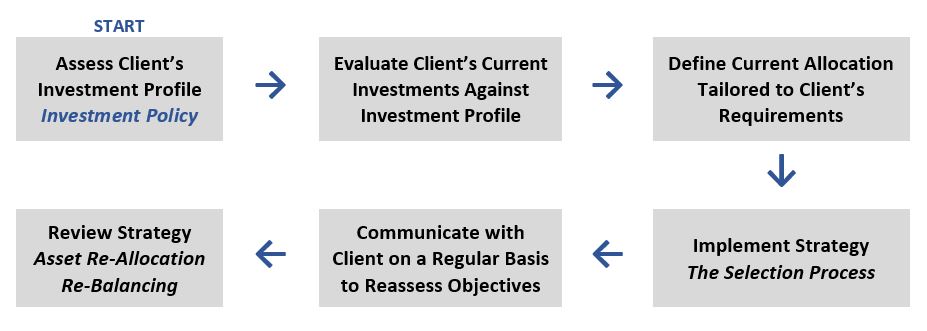

Under an Asset Management mandate, together, we will develop an investment strategy and approach that is right for you, based on a thorough understanding of your investment objectives, risk tolerance, and time horizon. Guided by these objectives, the portfolio manager(s) will then exercise discretion to construct and manage your investment portfolio. It will be kept under review and rebalanced as necessary to reflect changes in the outlook for particular investments, markets or asset types.

Our overall approach to Asset Management can be summarised below:

FAQs

Here are some answers to commonly asked questions. For more information on our Asset Management services, please contact us

Under an Asset Management mandate, does the client have any say or participation with respect to investments (the allocation of funds or selection of securities)?

No. Under an Asset Management mandate (a.k.a. Discretionary or Managed), the client’s input is confined solely to stating their objectives, risk tolerance and time horizon to achieve those objectives. Knotstone on the other hand, as Manager, will have discretion on all decisions of asset allocation and security selection.

Under Discretionary Mandates, do the types of holdings differ depending on the size of the portfolio?

Yes. Managed Portfolios below a certain asset threshold (typically circa EUR 5 million), will mostly be comprised of collective investment schemes (funds) or ETFs instead of individual securities (single name stocks and bonds), in order to enable sufficient diversification.

How are your Asset Management services priced?

Fees for Asset Management services are based on the assets under management (percentage or basis points per annum) of the specific portfolio being managed. Any transactions (buys/sells) within the portfolio are charged at cost (third party broker or exchange fees only). This pricing model removes a common conflict of interest ('overtrading') and aligns your interests with ours.